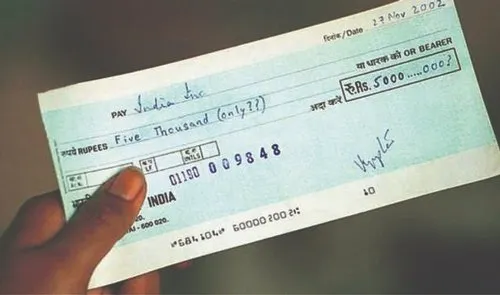

Fraudulent documents come in many forms… Sale deeds, Identity cards, Wills, Paper money, and so on. A Cheque is one such commonly counterfeited document. Cheques are made with security features for the identification of legitimacy.

While examining counterfeit cheques, there are overt (visible) features such as watermarks, logos, serial numbers, A/c numbers, etc. While these features, with an in-depth study, can be replicated to a certain extent by fraudsters, the covert (concealed) security features such as watermarks, color system, UV visible features, and micro lettering that are ingrained in the cheques require sophisticated attempts.

Cheques can also be tampered with in the form of erasures, overwriting, and termed as alterations. Erasures mean the removal of any writing or character from the document. For example, using a sharp tool like a blade to scrape the ink off a paper. Overwriting is writing something on top of pre-existing characters. Scratches, scribbles, or writings on top of previous writing are also considered as tampering with the cheque and will render it invalid. Alterations are changes or modifications made to the material. These alterations can be made with different writing instruments, sharp tools, etc.

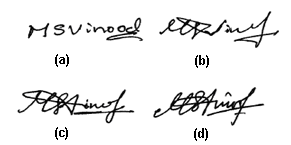

When a cheque has been tampered with or being questioned, particularly with civil or criminal litigations, it is referred to as disputed or questioned document. These questioned cheques are then submitted to a forensic lab for examination of the writings, signatures, and the document as a whole under various lighting/visualization instruments.

Most fraudulent cheques are suspected or caught by financial institutes, such as banks, who then forward them to document examiners for analysis and verification to Forensic labs is required.

Truth Labs has examined numerous varieties of alterations involving cheques. In one such instance, it was found that high skill and planning was employed by internal employees of a jewelry store to use chemical erasing technique which were detected in our labs. Many instances of alterations in the amount written as numbers and differences in inks used for writing are easily detected and analyzed by our experts. In some instances, the cheque had all the overt security features to make it appear authentic. But on closer examination using visualization tools, the experts were able to identify the absence of security features, such as the watermark, holograms, color system, paper quality, ultraviolet light features, pantographic image, and microscopic features.

Our questioned document reports have assisted numerous financial institutions, individuals, courts and police identify and prevent unlawful transactions which saved the banks and the victimized customers from losing their money.